Everything is constantly changing in the business world, from consumer needs, marketing strategies, and tech adoption, to government regulations. For a small business, the department that takes the biggest hit when these changes occur is the finance department. Your small business’ limited financial capabilities can’t allow you to fumble with finances as you adapt to the changing business landscape. You have to be prudent with your financial management. Here is how to do that:

1. Proper budgeting

A good budget should be ambitious but not unrealistic, fiscally responsible but not too timid, and accurate but not rigid. It should allow you to leverage business opportunities without jeopardizing your bottom line. Here’s how to create a good budget for your small business:

- Define, understand, and plan for all risks associated with your business, both short and long-term. For example, would changes in minimum wage requirements put your business in a financial crisis? Is your business prone to natural calamities? What financial impact would non-compliance to tax or employment laws have on your business?

Bottom line: Understanding potential risks helps you create a clear plan for your business’s financial future.

- Always overestimate expenses so that you don’t run into financial headwinds in case a project goes over budget.

- Understand your sales cycle. Learn to separate your off-seasons from peak seasons. You should know how much inventory to stock for a possible sales boom, how to ramp up your marketing efforts during peak seasons, and the optimal number of additional staff to hire on short-term contracts. You also need to know when to slow down and shed off potential dead weight or stock in readiness for the slow seasons.

- Involve your employees in the budgeting process. Allow them to scrutinize your budget estimates and give their expert advice. Their interaction with customers and the outside world gives them invaluable market insights that could be invaluable in your budget-making process.

- Use technology to collect and analyze relevant business data for a data-based budgeting process. For example, when budgeting for a marketing campaign, use market research tools to gain actionable insights into the campaign’s potential ROI (return on investment).

- Regularly revisit and revise your monthly and annual budgets as your business grows, costs fluctuate, and profit patterns evolve.

2. Business forecasting

Uncertainty reigns in the world of business. New technologies, new laws, pandemics, and many other factors beyond your control can precipitate abrupt and far-reaching impacts on your business. Regular business forecasting helps you prepare for future eventualities and take better control of future business performance.

The business forecasting process happens in 3 steps:

- Analysis of past business performance. This is where you analyze past experiences, e.g. analyzing sales cycles to determine your peak and low seasons. Past business patterns are likely to recur in the future. This analysis tells you how much inventory to stock in which season for optimal profitability.

- Analysis of current trends within your niche. This is where you analyze competitor performance to get insights into their marketing, branding, and other business practices that could influence the future of business.

- Analysis of relevant factors outside of your niche, e.g. changing political landscape, weather patterns, etc.

Here are some of the business forecasting tools you can try.

3. Automate the invoicing process

Processing invoices manually can be tedious, time-consuming, and prone to costly human errors. You can, for example, forget to send invoices in good time, which means you won’t get paid in good time. Automation makes it seamless to create billing documents, set payment terms, and send out written estimates in advance. You can use invoice automation software to modify invoices, cancel invoices when necessary, and send them in good time for accelerated payments. Good invoicing software also comes with powerful reporting tools that help you make accurate cash flow projections. Automation also makes it easier for clients to make partial and full payments via PayPal, Stripe, credit card, and other digital payment options.

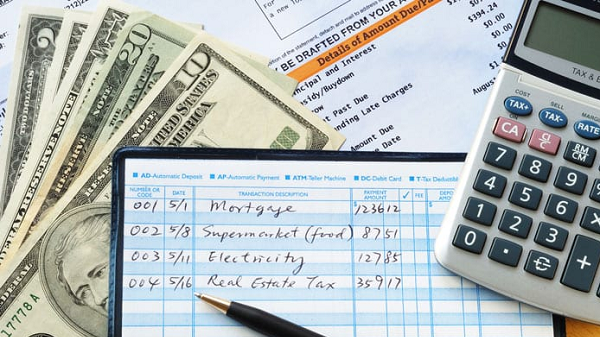

4. Expense tracking

Tracking expenses makes you wiser in managing expenses. It tells you whether you made the most appropriate budget allocations, so you can make timely adjustments if necessary. It helps you identify unnecessary expenses early enough to prevent wastage. Most importantly, it helps you set your daily transaction limit based on your average daily cash flow. There are a handful of business expense trackers that you can use for this exercise.

Final word

Let’s be honest: Financial management is hard and tedious for small business owners. That’s why it is the least exciting part of business management. The 4 steps above will, however, help you manage your finances without tearing your hair out. Just remember to find the right automation tools for each process.

Read also:

- Rising Importance of Data Security for Businesses

- How to Use Tech Advancements to Recover Sales of Your Business?

- Business Tips: The Importance Of Having A Good Logo

- How Enterprise Application Development Benefits Your Business

- A Guide to Incorporating eCommerce Into Your Business

- How to Use Creative Tech Design Innovations to Further Your Business?

- Tech and Business: How to Utilize Technology to Reach More Clients?

- 3 Best Board Portal Software Solutions for a Big Business